click for Menthol Market Updates :: 2024 - 2025 ::

click for Menthol Market Updates :: 2023 ::

click for Menthol Market Updates :: 2022 ::

click for Menthol Market Updates :: 2019 ::

click for Menthol Market Updates :: 2018 ::

click for Menthol Market Updates :: 2017 ::

click for Menthol Market Updates :: 2016 ::

click for Menthol Market Updates :: 2014 ::

click for Menthol Market Updates :: 2012 ::

click for Menthol Market Updates :: 2009 ::

click for Menthol Market Updates :: 2005 ::

Menthol Market Updates :: 2012 ::

MENTHA OIL

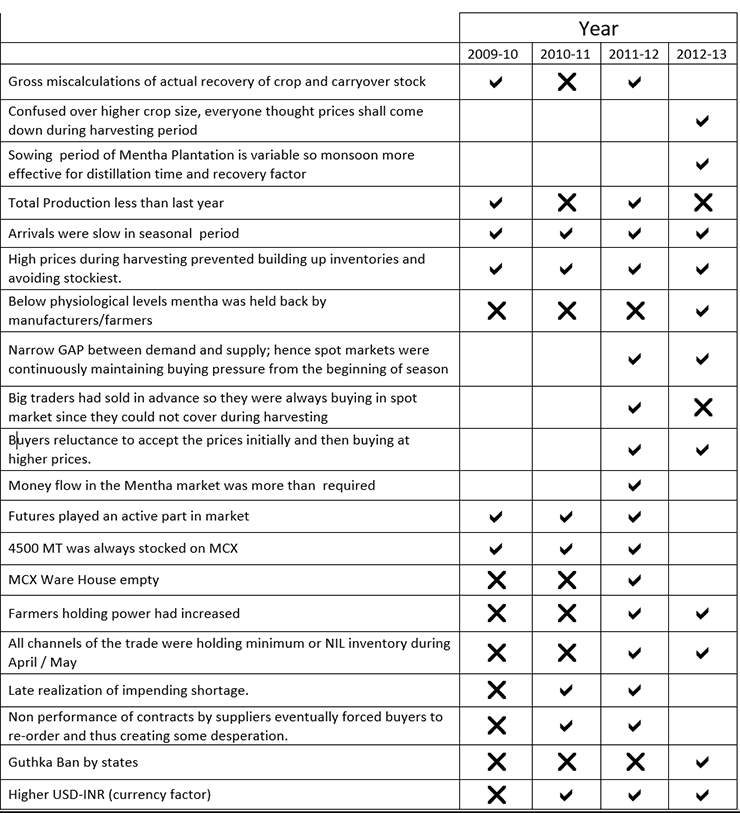

Mentha Oil has been the talk of town after breaking its record prices of almost 16 years. Mentha oil is the only commodity after Guarseed which has given hefty returns to the supply chain from farmers to investors. Mentha oil which showed a season low of Rs 811 per kg in futures in May 2011, jumped nearly by more than 200% to record highest price of Rs 2580.10 per Kg on the back of strong demand and poor stocks.

The aftermath crash in prices just before the new crop arrivals has taken all the stakeholders on ride for the journey ahead in current year. Mentha oil futures almost hit 13 continuous lower circuit breakers a phenomenon not seen in Indian commodity futures.

In the last decade this year has been the only incidence when mentha prices maintained the record higher levels for more than 2 months in a row. Earlier spurts in mentha oil were short lived, not lasting a couple of months.

Hence, it’s now high time to review the market scenario so as to take position to avoid risk and minimize losses.

Mentha oil is derived from a plant named Mentha arvensis or common mint. Mentha arvensis is a European mint herb that is adopted by the United States. It is a long lasting, quick growing, hairy leaved herb that can even attain a height of 1.5 meters if favorable conditions are provided. ‘Mentha’, actually, is a Latin name for ‘mint’. With the help of steam distillation process, mentha oil is obtained from the fresh leaves of that plant followed by the separation of menthol from it.

Mentha oil is extremely useful in a wide variety of industries namely food industry, pharmaceutical industry and also in perfumery and flavoring industries. Also, the constituents and derivatives of mentha oil like mint and menthol are used widely.

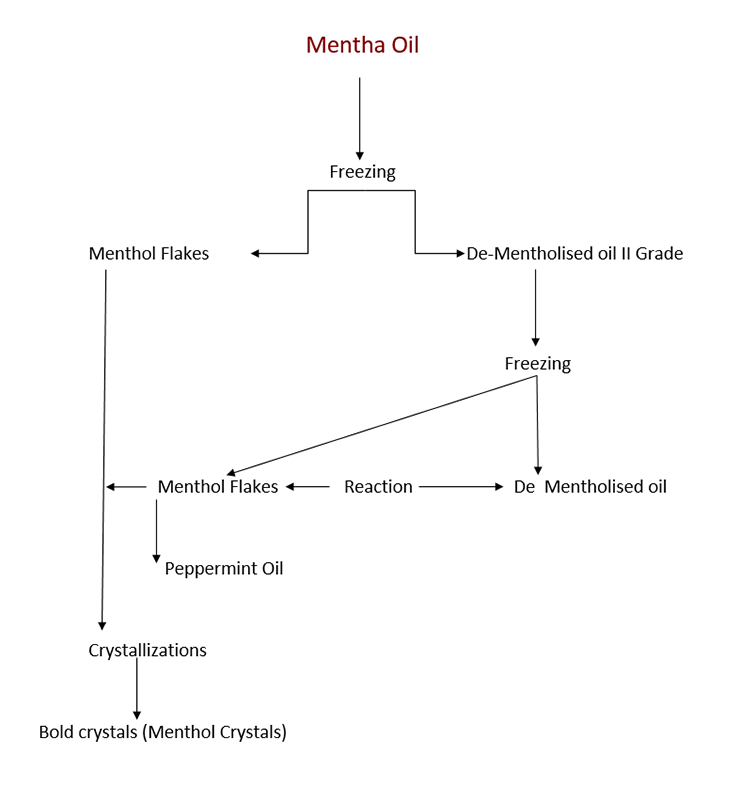

Menthol is the major derivative product of mentha oil. Majority of the oil is converted into menthol, which is so important that it is even considered as one the basic uses of mint oil. It is extracted through a complex process that involves cooling of the oil slowly, which turns the oil into crystal form and then it is centrifuged and dried to attain a yellow colored substance called menthol. This oil like substance is often required by the medicine industry and it is used in balms, cough drops, inhalers, toothpastes, mouthwashes etc. Around 40% to 50% menthol and around 50% to 60% dementholized oil is obtained from mentha oil in the production process of menthol. Dementholized oil is used in confectioneries and peppermint oil.

Let’s recap 2011-12 prices Trend

Towards the season start of 2011-2012, industry players anticipated 25% higher crop on the back of 25% rise in area

However due to bad weather conditions, production proved to be sharply lower than anticipation which was realized very late by industry

The industry was holding lower stocks at the start of 2011 season

The season started with higher prices, and stockiest kept away from Mentha Oil

Manufactures too procured stocks to cover export commitments which was hand to mouth

In the first half of season, the supply remained steady but towards the second half of year as the supply squeezed, traders and importers ran to cover short positions for their positions

Speculators were short on futures and even exporters to some extent were uncovered on expectation of higher mentha oil production

Narrow GAP between demand and supply always kept buyers active in the market

With every record price, stocks with stockiest came out of the warehouses, making end inventories tighter

Hence buyers reluctant to enter at the start of season had to accept higher prices later

Non performance of contracts by suppliers eventually forced buyers to re-order and thus creating some desperation.

Weakening of rupee to record lows, made it lucrative for exporters

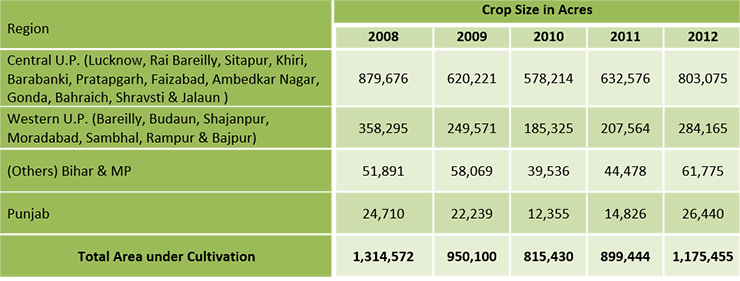

Crop- area

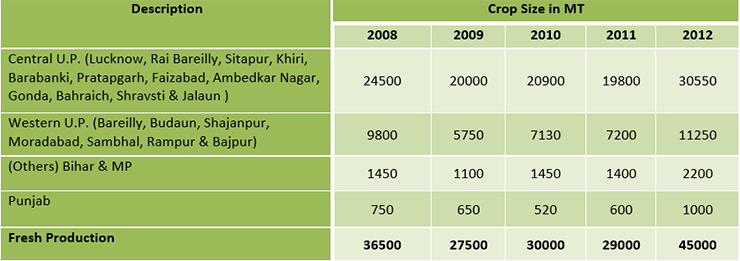

Regional – production

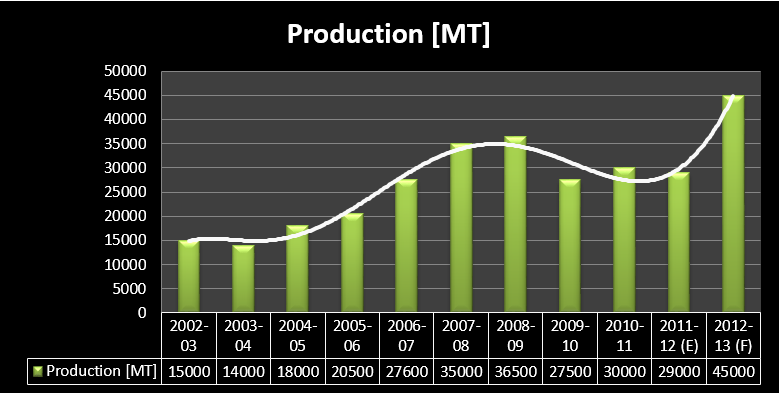

Production

India is the largest producer and exporter of mentha oil in the world.

Also, this is very important to note that Mentha Crop is largely planted in only one State of India, namely Uttar Pradesh. In UP only in 4 districts have major contribution towards the production of mentha oil.

The crop has been on a growth of 25% CAGR basis from 2010 to 2012. However, the growth in crop could not be converted into the growth in mentha oil production because of untimely monsoon rains, poor skilled labour, and diseases. Also mentha being third crop in the year, farmers do not get proper time for harvesting.

The production of mentha oil is forecasted to rise to record 40,000 MT in the current year, after a fall in last 3 years.

Historically, year on year production has never varied by more than 35% in the last 16 years.

The forecasted crop in 2012-2013 would be the highest in history. Any further rise in area would not be feasible given the soil conditions and weather conditions required for the crop.

Mentha economics

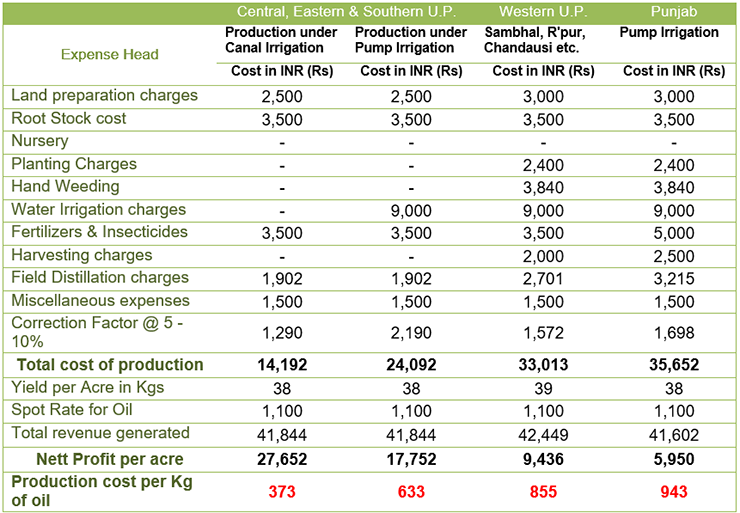

Mentha Arvensis Cost of Cultivation for Various Growing Areas in India (Per Acre Cost)

Yearly high low

From 2004-2005, normally mentha prices doubles from the lows of the season

The 244% growth in prices from the lows made last year are record

However, the prices have crashed by around 50% from the recent highs.

Normally the season low is made in the month of May- June during the peak arrivals period

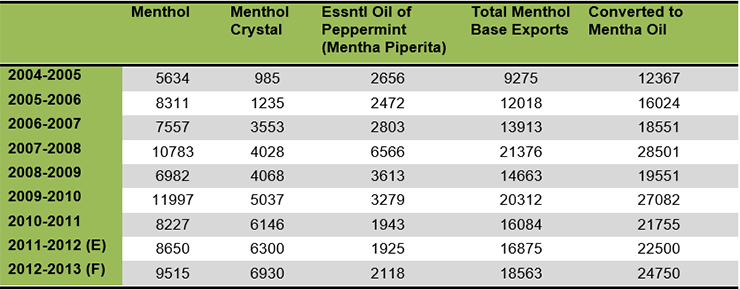

Mentha Oil Exports

Department of Commerce Export Import Data Bank -Mentha oil Export

| 29061100 | MENTHOL |

| 30039021 | MENTHOL CRYSTAL |

| 33012400 | ESSNTL OIL OF PEPPERMINT (MENTHA PIPERITA) |

ITC HS Code of the Commodity is either dropped or re-allocated from April 2004

Quantity in Thousands

2011-2012 (E)- Trade Estimates

2012-2013 (F)- Trade Forecasts

** 100 Kg of Mentha oil produces 75 kg of Menthol

Since there is no separate data on mentha piperata exports, the exports could vary by 500-600 MT

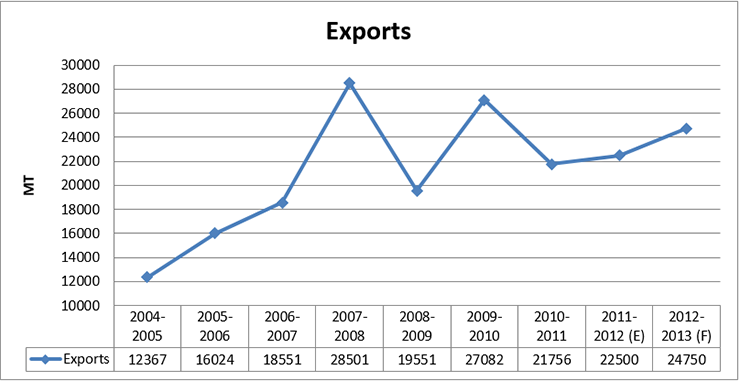

Mentha Oil Exports

Mentha oil is an export oriented commodity as most of the production is exported

Mentha oil exports have seen a sharp jump in 2007-2008

After the economic doldrums in 2008-2009, sharp slump in exports was seen. However, importers consumed their stocks making the inventories levels sharply lower at their disposals.

Exports forecasted to be higher as most of the inventories have been utilized by importers and consumers

Mentha oil exports have been on rise from last couple of years followed by entry of two major sectors of talcum powder and cooling hair oil.

With current order book with exporters, European crisis is still to affect the exports, rather exports are forecasted to grow under current situation

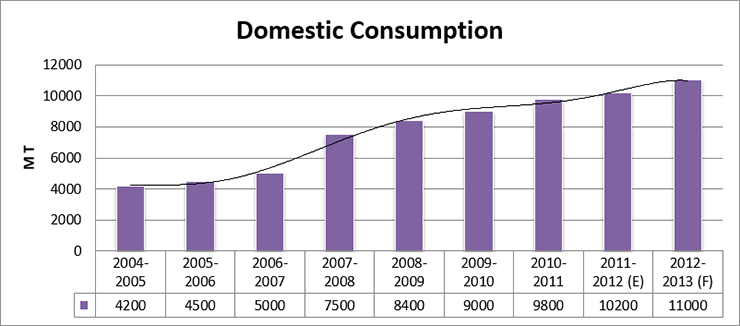

Domestic Consumptions

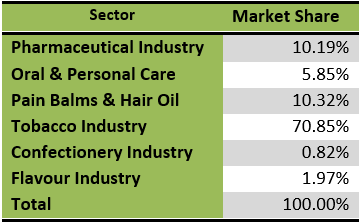

Sectorial Consumption

With the growing consumption of guthka and increased in FMCG sector, domestic consumption of mentha oil have been on the rise over the last decade.

There has been healthy growth in sectors such as deos, cooling hair oil and talcum powders, a growth seen rapid in rural parts of the country.

According to an industry report, deos are growing at a healthy 45-50 per cent, while growth in the talcum powder segment is estimated at about six per cent in India

Almost 5% (2000 MT) of mentha oil is always under production cycle and could not be utilized consumption.

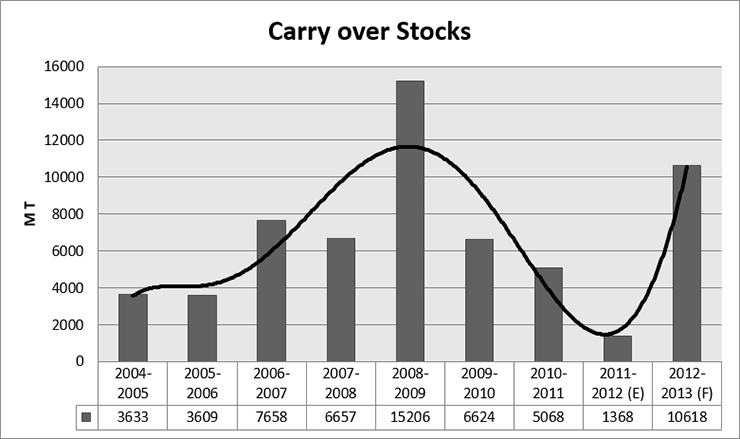

Carry Forward Stocks

Mentha oil industry has normally seen an average carryover stocks of 15-20% of the annual production

However, in 2008-2009 with the sharp contradiction in exports, the carryover stocks rose to record levels.

The record stocks depleted with the fast consumption of the commodity leading to sharp fall in stocks

In 2011-2012, the carryover stocks were at the lowest levels leading to a panic among buyers and making record higher prices ahead of new crop arrivals

Currently, most of the stocks are held by investors and industry stocks are at negligible levels

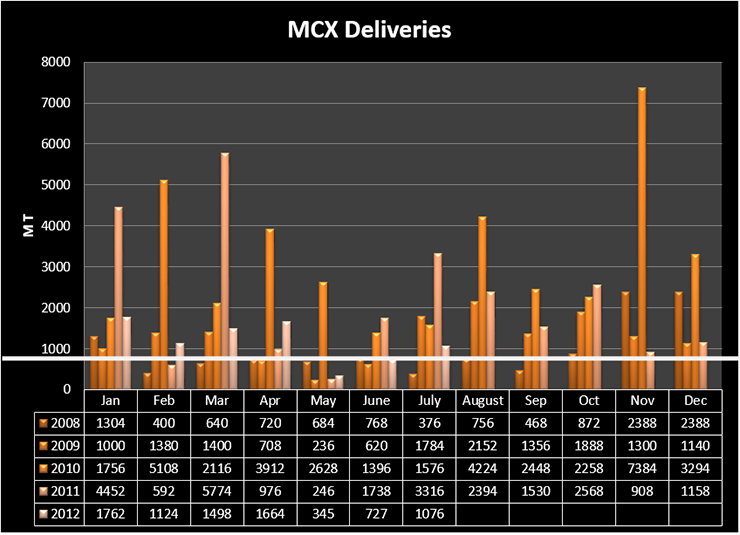

Mentha oil deliveries on MCX

The average lots delivered on MCX is always higher than 500 lots

May contracts have witnessed the lowest deliveries of the season since 2009

This year again May contract may witness one of the least deliveries on account of poor carry over stocks

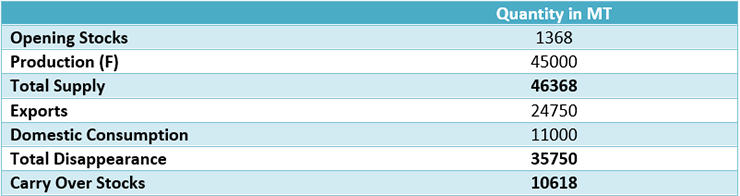

THE YEAR AHEAD 2012-2013

Mentha Oil 2012-13

Arrivals Flow

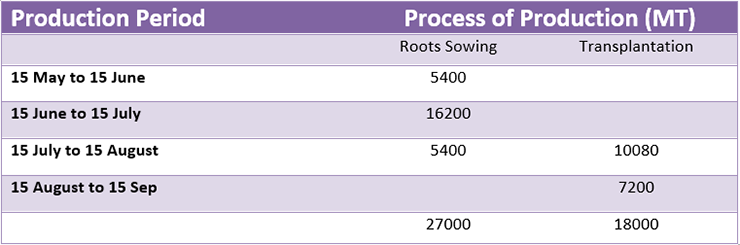

Mentha oil arrivals starts from the roots sowing crop from 15th May and ends until 15th September with transplantation crop

The period from 15th June to 15th August being most important as more than 70% of mentha oil is produced during the period

Any weather disruptions from monsoon, continuous heavy rains could deter production and arrivals

The number of distilleries have increased sharply and hence mentha oil production with at higher pace

However, if monsoon gets prolonged and any extension of dry period would sharply raise the recovery rate of mentha oil

Planning for year ahead

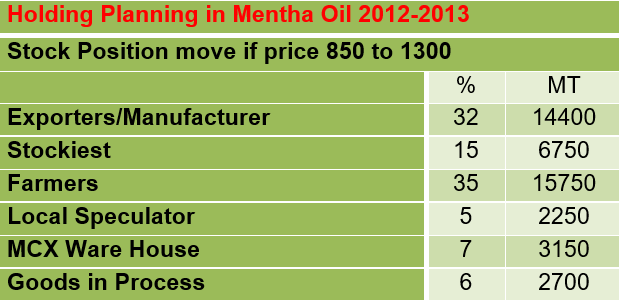

The following could be the holding pattern in mentha oil in the coming year as per traders

Category I- If Prices between 1300-2000 per Kg

Category II- If Prices between 850-1300 per Kg

Note- Currently industry players do not expect prices to go above Rs 2000 per Kg levels, unless there is some real supply threat.

Concerns over Synthetic mentha

justified?

There have been reports of synthetic mentha oil production by BASF which would commence in 2012

The higher prices of mentha is because of the supply demand gap and hence there is always room for higher supply to get accommodate

However, with the world shifting focus towards organic crops the acceptance of synthetic mentha would always be questioned especially in food industry

There could be some change in process of industry with synthetic mentha, hence it would not be economic for consumers to change the ingredients on rise in raw material

Change in ingredients comes with higher cost such as change in patents formulation and labeling costs

Real Threats

The biggest consumer of mentha oil is guthka industry, and any jolt (banning of guthka in states or country as well) would be negatively impacted

Already states of Kerala, Madhya Pradesh and Bihar has imposed partial or total ban the sale of tobacco and nicotine-mixed guthka and pan masala

Although, synthetic mentha oil is just an theoretical threat as of now, sharply higher prices could result in demand shifting to synthetic mentha oil, at least in some segments

If there is higher recovery of mentha oil, production estimates could take everyone at surprise and production could be much higher

Arrival of monsoon early during distillation stage could sharply lower the output estimates BUT, delay in monsoon or faster completion of distillation could result in much higher production of mentha oil

Factors affecting price trend

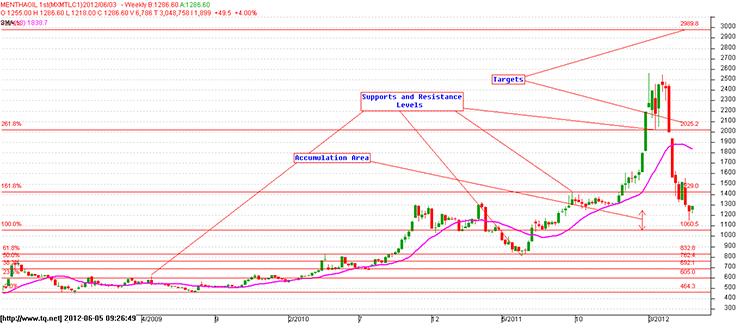

Technical outlook

Technically speaking Last Year Mentha Oil rallied after giving a breakout of Rs.1328. The rally continued till Rs.2565 and now the prices have bottomed around Rs.1150-1250 levels after touching the low of Rs.1148. Prices have already corrected by more than 50% and are due for a 50% pullback from here on.

Positional Players can go Long at Rs.1218-1260 and on dips to Rs.1168 for the positional target of Rs.2025 with Stop loss below Rs.1059.

Summary

The current year is staring with one of the lowest stock to use ratio in last decade, hence any supply side threat could lead to panic buying from consumers

Industry players are currently consuming the inventories and hence awaiting to built the stocks once arrivals starts flowing into the markets

Since arrivals are expected to be higher on increase in number of distilleries, capital requirement would be higher and could create liquidity crunch, pulling prices down

There have been reports or delayed monsoon or deficit rains, this could lead to higher recovery of mentha oil

If the year starts with higher prices, farmers selling could rise, also there could be some demand destruction and prices could falter once pipeline gets filled

If the year starts with lower price base, farmers selling would be limited in expectation of better returns ahead and the supply chain would remain dry amid higher consumption at lower prices

The production in India is currently at its peak levels, any further increase in mentha oil production seems unviable in the country given the fact of weather conditions and soil requirements, and hence synthetic mentha will just fill the demand gap.