click for Menthol Market Updates :: 2024 - 2025 ::

click for Menthol Market Updates :: 2023 ::

click for Menthol Market Updates :: 2022 ::

click for Menthol Market Updates :: 2019 ::

click for Menthol Market Updates :: 2018 ::

click for Menthol Market Updates :: 2017 ::

click for Menthol Market Updates :: 2016 ::

click for Menthol Market Updates :: 2014 ::

click for Menthol Market Updates :: 2012 ::

click for Menthol Market Updates :: 2009 ::

click for Menthol Market Updates :: 2005 ::

Menthol Market Updates :: 2014 ::

Mentha Oil

In our previous reports generated in 2012-2013 we had summarized the scenario of mentha oil industry during that time. This year since synthetic menthol has become a reality and we have included the same.

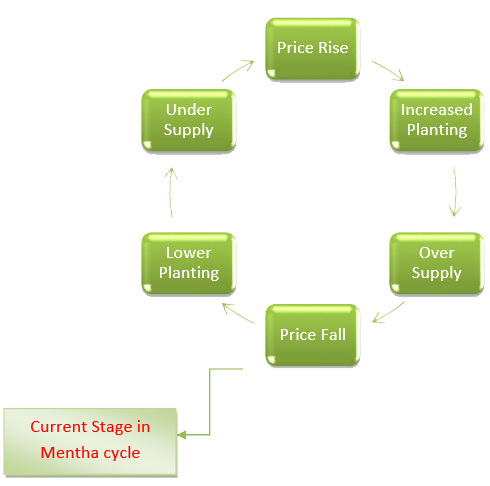

Cycle of price fluctuation

Any market is price elastic and prices changes the demand supply scenario

Example- If there is increase in demand of petroleum products- prices increases, as a result there is growth in industry as a result new wells are being discovered and explored to increase the supply and cool prices.

Currently we are in a cycle phase where in prices have started falling sharply in mentha oil

Plantings are likely to fall firstly to due lower prices and secondly due to saturation of crop area, corn crop is more remunerative.

Let’s recap 2013-14 mentha year

The season start of 2013-2014, was marked with a year with bearish note, prices fell sharply with the start of new crop and were traded lower for the rest of year.

The crop area was mostly at the higher end and further rise in area is remotely not possible now.

Mentha oil production lagged from the initial target due to yield losses due to unfavorable weather conditions.

Carry Over stocks were at comfortable level

With the start of Synthetic mentha oil production in Germany and Japan, menthol consumers felt secured in the supply of the same.

The world’s top ten consumers have already started shifting to synthetic menthol and hence Indian mentha oil is less volatile.

Prices traded in a narrow range in futures with lackluster speculative activities, leading to a dull activity in spot as well.

Off late strengthening of Indian Rupee made the activity dull for exporters.

Mentha oil Production

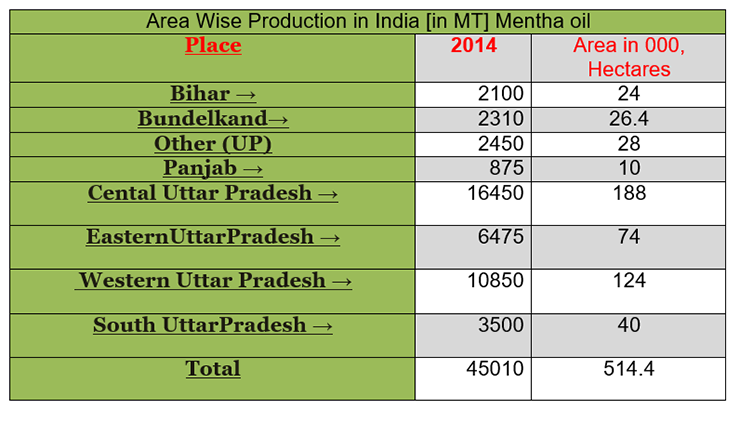

India is the largest producer and exporter of mentha oil in the world.

Also, this is very important to note that Mentha Crop is largely planted in only one State of India, namely Uttar Pradesh. In UP only in 4 districts have major contribution towards the production of mentha oil.

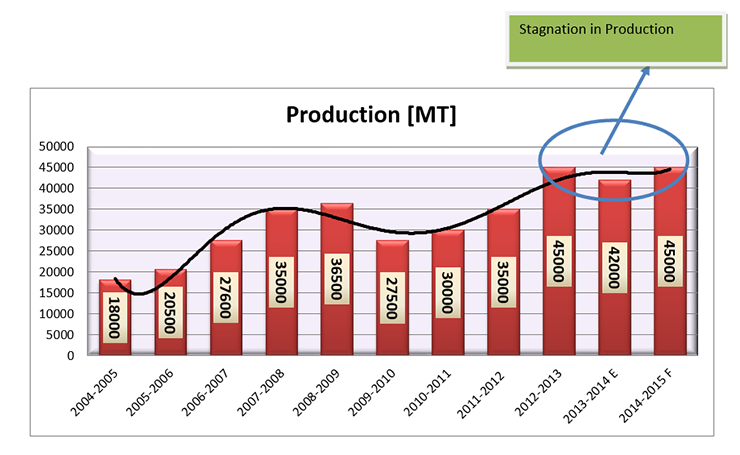

The crop has been on a growth of 25% CAGR basis from 2010 to 2012. However, in the last couple of years the production remained stagnant, largely due to lower yields in 2013-2014 due to untimely rains.

The forecasted crop in 2014-2015 would match to the highest crop recorded for the same in 2012-2013. Any further rise in area would not be feasible given the soil conditions and weather conditions required for the crop.

Also, any unfavorable weather anomalies during the harvest season could lower the production of the crop.

Since mentha is produced in a limited are of Uttar Pradesh totaling four districts further addition in area seems remote unless there is huge price remuneration for farmers.

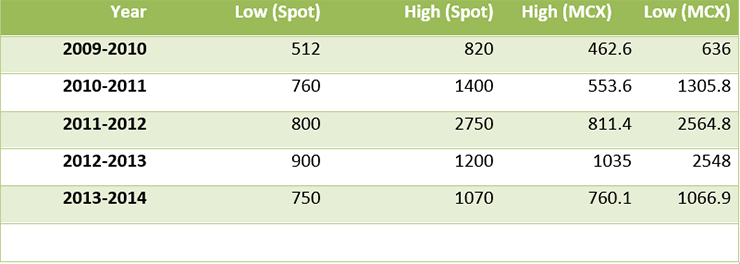

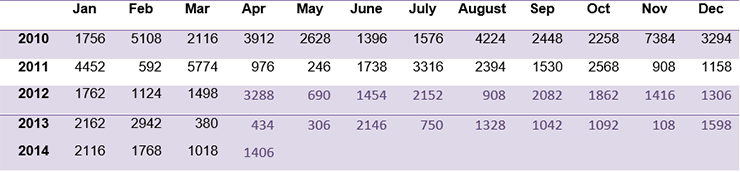

Spot Prices- Annual high low

During the last 10 years, the prices doubled from the lows of the year to the highs on an average.

During the year 2012-2013 with the supply of synthetic menthol, prices have become less volatile.

Prices seems to be in a consolidate phase in last couple of years, waiting for an either side move.

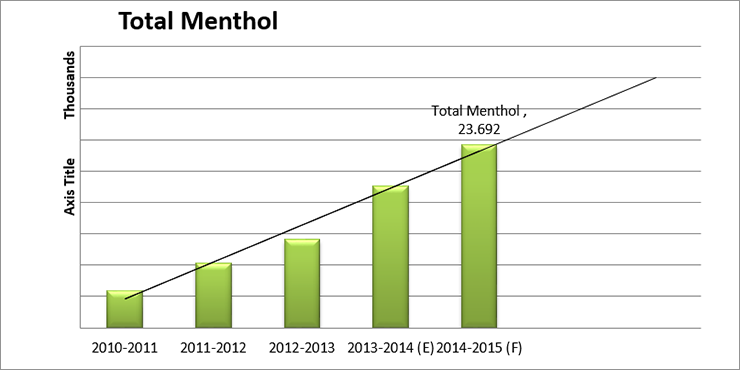

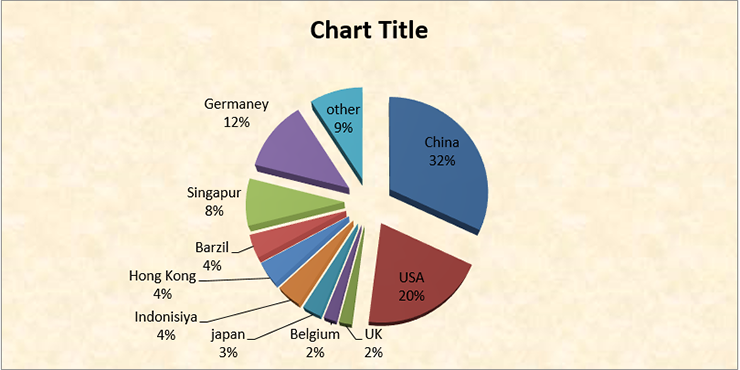

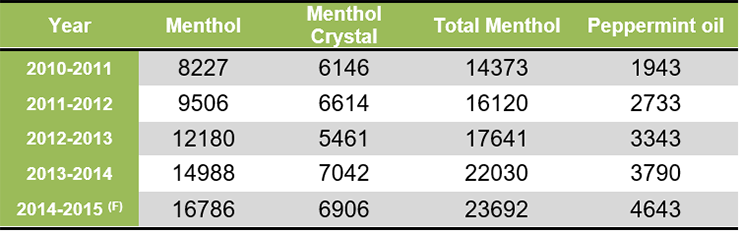

Menthol Exports from India

Department of Commerce Export Import Data Bank-Mentha oil Export

Menthol is an export oriented commodity as most of the production is exported

Mentha oil exports have been on rise in the last decade, only a contradiction seen during the global economic slowdown during

2016 is most important year demand so high in international market and Indian production go down

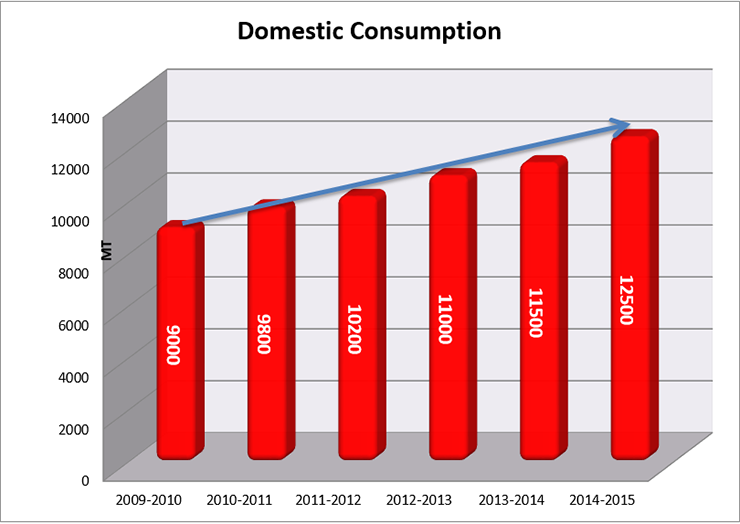

Domestic Consumption

With the growing consumption of perfumes, deodorants and scented mouth fresheners, in FMCG sector, domestic consumption of mentha oil have been on the rise over the last decade.

There has been healthy growth in sectors such as cooling hair oil and talcum powders, a growth seen rapid in rural parts of the country.

According to an industry report, deodorants are growing at a healthy 45-50 per cent, while growth in the talcum powder segment is estimated at about six per cent in India

The demand of mentha oil is also increasing in China and other Asian countries.

Synthetic menthol- a reality

Many in the industry were worried a couple of years about the possible supply of synthetic menthol and its impact on the domestic scenario for mentha oil.

The essence of synthetic menthol lies in fixed production capacity with most detrimental price.

While synthetic menthol has succeeded in containing the price violating of mentha oil in domestic markets; there has been no impact of this surplus supply of menthol for Indian exports.

This indicates a stronger global market for menthol.

While most synthetic menthol producing companies used to consume the produce for their self-consumption, the surplus production has been coming in the markets since rise in production capacity in last couple of years.

Synthetic mentha is now playing a major role in decreasing the price volatility as production of synthetic menthol is assured leaving behind the factors of mentha oil such as crop area, weather and remuneration vis-à-vis other crops.

Global majors such as BASF, Symrise and Takasago had entered the production of synthetic menthol and have been increasing the production since 2012.

Considering the size and business volumes of these majors there could be substantial rise in production of synthetic menthol from international players going ahead.

Importance of MCX

MCX has been acted as a major platform ensuring smooth deliveries of Mentha Oil.

On an average 4400 MT of mentha oil has been delivered through MCX on an annual basis in the last four years.

Hence the role of MCX would remain critical in ensuring supply of mentha.

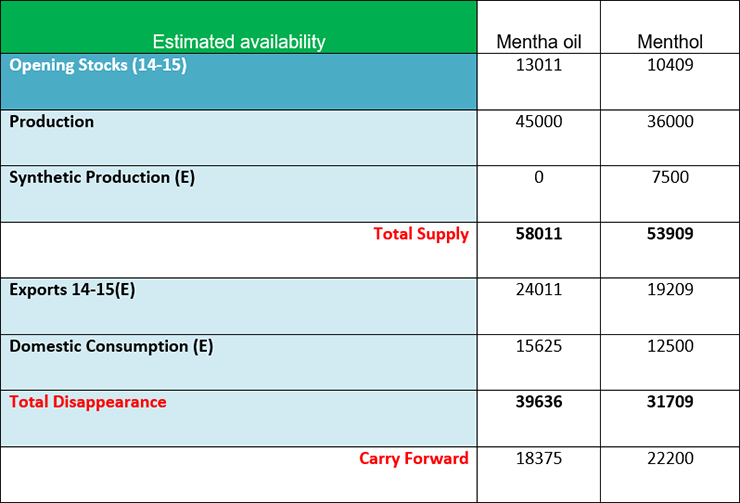

Indian balance sheet

During the last two years there have been adequate surplus stocks so as to keep a lid in prices.

Out of the above stocks 4000 MT of menthol equivalent goods are always in supply chain and in MCX warehouses.

If one has to consider the goods in supply and the warehouse stocks of MCX, the supply would be rather tighter.

Mentha oil industry has normally seen an average carryover stocks of 20% of the annual production in the last decade.

However, if exports remain at the expected pace, the carryover stocks at the end of current marketing year could be as low as around 6-7% of this year’s production.

In 2011-2012, the carryover stocks were around 13% leading to a panic among buyers and making record prices

Global mentha oil/ Menthol scenario 2014-15

If we consider 4000 MT of menthol which is in supply chain and MCX warehouse stocks, one would find that the carryover stocks would be in negative.

In such a case there would be withdrawal of stocks from MCX or exports have to be moderated by rise in price.

With the current pace of exports of mentha oil products from India, the balance sheet indicates negative carry over, indicating possible supply squeeze towards the end of season.

Although the MENTHOL end stocks looks positive, mentha oil is expected to be short supply.

Hence there could be a spike in price so as to deter the growing pace of exports of mentha oil from the country.

*Conversion Factor 0.8 for Mentha oil to Menthol.

Technicaloutlook

Strategy for the entire year: Mentha is trading in a narrow range of Rs.830-892 from last 9 weeks.

Buying opportunity for positional players with SL below 640.

Immediate closed 636 then enter in market buying side

In Long term: A Breakout above 892 should target Rs.965. and a close above 970 will continue the rally towards Rs.1111.

Summary

Mentha oil production which has been rising over the last decade seems to be at its peak level due to maximum area diversion to the crop in the producing region in the last couple of years.

Any further rise in area would need some attraction in price for farmers.

Exports of Menthol has seen exponential rise in the last decade.

Domestic consumption of Menthol has been on rise thanks to fragrance and FMCG industry.

Carry forward stocks for the year 2014-2015 seems to be under stress, so as to withdraw stocks from MCX or even supply chain; a rise in price would be required to contain the growing exports.

Synthetic Menthol has turned out to be reality in the sector to contain price volatility.

The price of synthetic menthol and volumes of production can be fixed easily.

With the growing production and supply of synthetic menthol, global supply of menthol is likely to address any short in supply from India.

Piperita oil

The current year production is lower by 20% at 550 MT with a carry-forward stocks of around100 MT price touch 1100 all crop distilled

Prices are likely to firm up and double from current levels; with lower availability of the crop.

Spearmint oil