click for Menthol Market Updates :: 2024 - 2025 ::

click for Menthol Market Updates :: 2023 ::

click for Menthol Market Updates :: 2022 ::

click for Menthol Market Updates :: 2019 ::

click for Menthol Market Updates :: 2018 ::

click for Menthol Market Updates :: 2017 ::

click for Menthol Market Updates :: 2016 ::

click for Menthol Market Updates :: 2014 ::

click for Menthol Market Updates :: 2012 ::

click for Menthol Market Updates :: 2009 ::

click for Menthol Market Updates :: 2005 ::

Menthol Market Updates :: 2016 ::

Mentha Oil

_2016.png)

Minting Money with Mentha Oil (MENTHOL)

In our previous market reports of 2012-13 and 2014-15 (the same are available on our website: www.prkchemicals.com), we had summarized the Menthol industry during that period.

Year 2012 saw the advent of Synthetic Menthol, in a big way courtesy BASF, and thus was born a rivalry between Natural Menthol and Synthetic Menthol. Lately it has become Indian Mint Framers- producers of Natural Menthol v/s Synthetic Menthol.

Synthetic Menthol has struck at the core (price/speculation) of Natural Menthol and it has brought a Price Barrier for natural menthol. Gone are the days of extreme high/ volatile prices. Now the battlefield is ‘PRICE”.

When the prices were at peak levels, few years back Synthetic Menthol became the factor which covered the lid on prices and speculation. Now, Indian farmer and particularly traders on futures markets (MCX) have to decide as to what level they can bring down the prices, in order to challenge the feasibility of Synthetic Menthol production.

The basic objective of Synthetic Menthol is to kill the speculation and provide supply of Synthetic Menthol and thus, take control of prices away from India. Some 900 MT of Synthetic Menthol was brought in India by a multinational company (to facilitate their exports commitments). The same quantity was earlier procured from within India. This has cautioned the menthol traders/manufacturers and they are lowering their investment. Indian farmers had also lowered the cultivation.

It was presumed that the cost of Synthetic Menthol is between $ 13.50-14.50/kg. But the manufacturers were supplying at close to $ 12.50/kg, probably because of some old commitments. Whereas Natural menthol, was priced around $ 16.50/Kg. It appears now that both are comfortable at these price levels.

Let’s recap 2015-16 mentha year

-

The prices of Mentha were high during season because the production was about 40% less than last year.

-

The inventories in MCX warehouses very high, unprecedented- mostly because of hedging tool.

-

Exporters had comfortable and sufficient inventories.

-

In First half of 2015 season the demand and supply was complementing and matching so prices and supplies remained firm. But in second half the demand started receding and price started easing.

-

The gap between demand and supply was increasing.

-

The bull speculators were not able to accept bearish trends until December and kept on incurring losses.

-

Importers got intelligent and slowed down their purchases.

-

Carry over stock were at comfortable levels.

-

Weakening of Indian Rupee.

-

3rd quarter had low prices and created good demand.

-

Synthetic had actually busted out the speculation.

-

The pricing control has gone back to buyers.

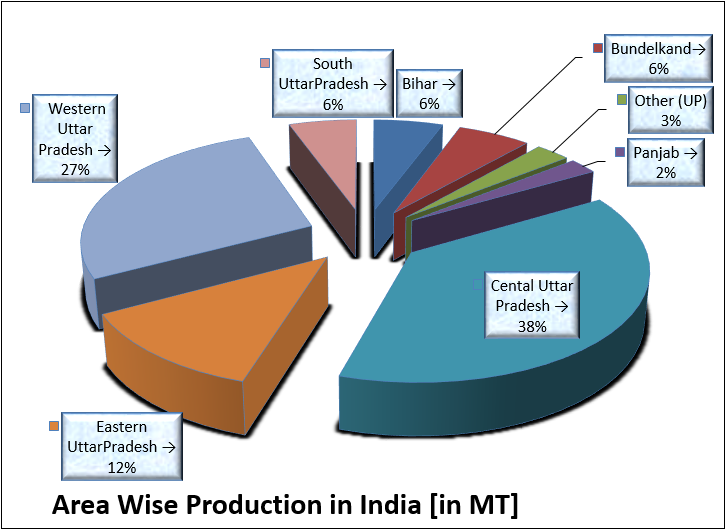

Area Wise Production in India [in MT]

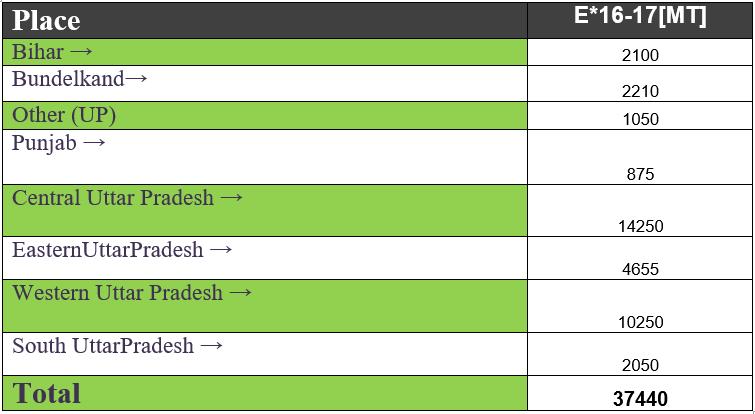

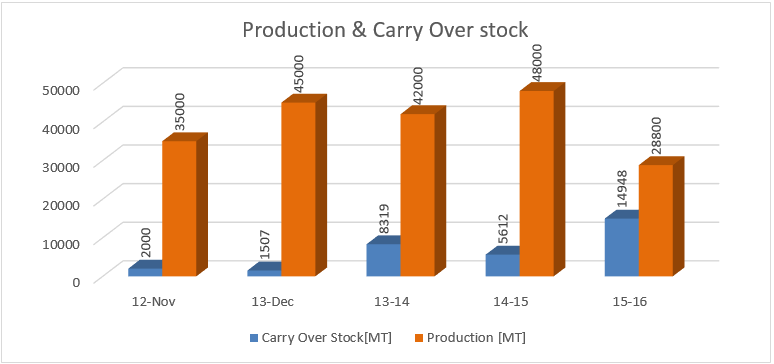

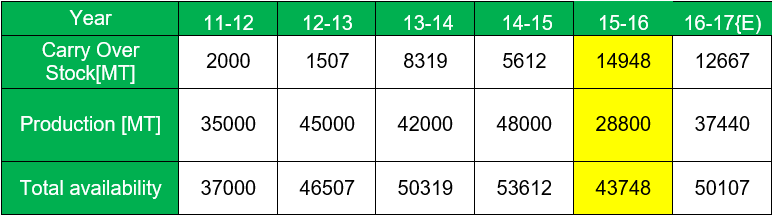

Mentha oil Production

Total Availability of Mentha oil[MT]

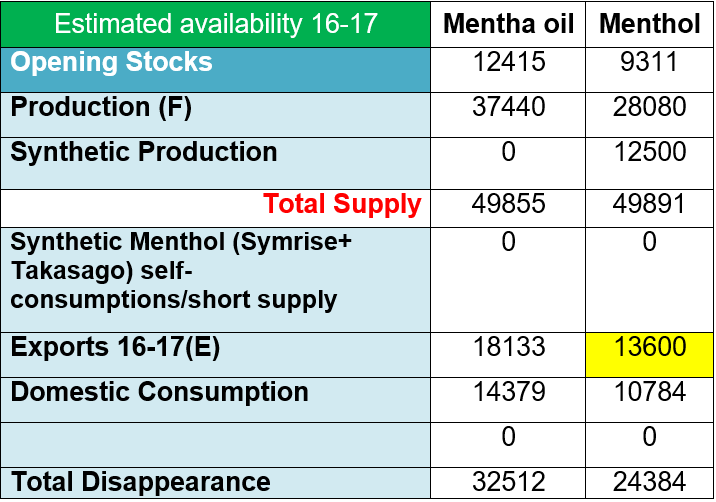

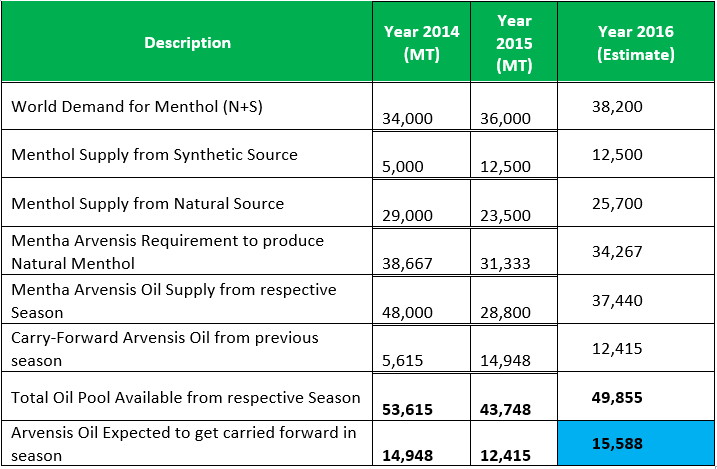

If we look at the statistics of last six years then we can very safely reach a conclusion that the production level of Mentha oil is more or less fixed, with the exception of last year. In favorable conditions years the oil production shall be a maximum of 45,000 MT -with prices lucrative for farmers and in adverse conditions a minimum of 28,800 MT. Carry forward stocks largely vary between 5612 MT to 14948 MT.

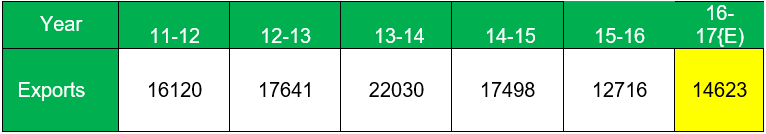

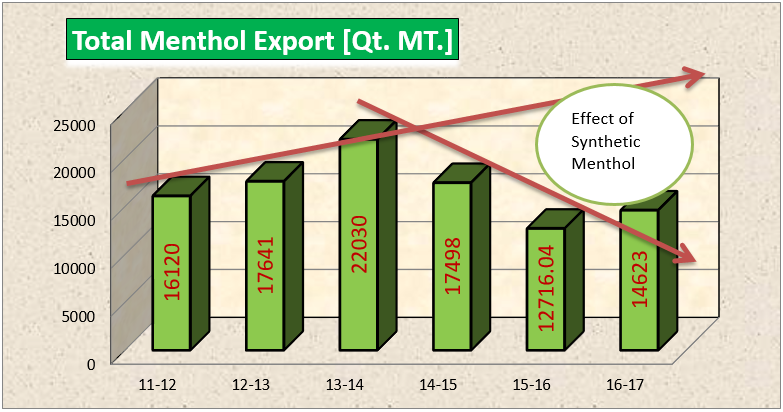

Total Menthol Export [Qt. MT.]

-

Exports were 30% lower than last year

-

7% domestic consumption will grow this year as per our latest calculations

-

100 Kg of Mentha oil produces 75 kg of Menthol

-

Indian Consumptions 11500 less synthetic menthol import 905

-

Production this year to increase by 30% compared to the last year

-

HS Code Menthol Crystal 29061100, Menthol Crystal 30039021, Peppermint oil 33012400

-

Lowering of exports was mainly because of weakening of Chinese economy with lead to most Chinese companies to lower their inventories levels.

-

If prices remains low in India (around $14 to $15), exports can touch 2014-15 levels

-

In the above graph we have enhanced the growth at 7% maximum because large consumers have shifted their loyalties to Synthetic Menthol.

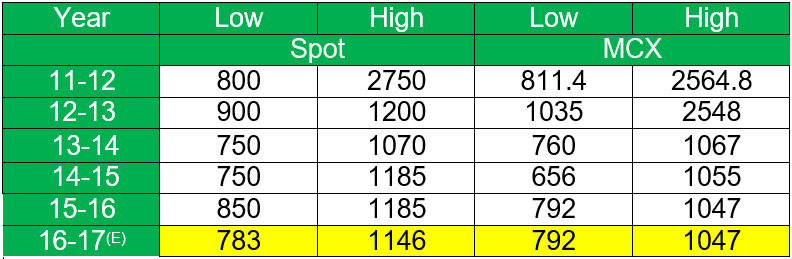

SPOT PRICES- ANNUAL HIGH LOW

-

Last three year Mentha oil dissuade the low and high level

-

During the last 10 years, the prices doubled from the lows of the year to the highs on an average.

-

During the year 2012-2013 with the supply of synthetic menthol, volatility in prices have decreased.

-

Prices seem to be in a consolidation phase in last couple of years, waiting for an either side move.

Estimated Availability Mentha oil 16-17

World Demand and supply natural & synthetic

Plans to take on Synthetic

-

As we had mentioned in our report of 2014, the history of Menthol shall be written as Pre 2012 and post 2012.Goliath (Natural Menthol) has been challenged by David (Synthetic Menthol). 6000 MT is challenging 45,000 MT.

-

BASF, Takasago and Symrise have reached a production of 12,500 MT and are giving a tough competition to Natural menthol. DL Menthol consumption has also reached 500 MT. Goliath shall have to be very cautious of David

-

Providing new species of menthe to farmers, a species which can give a production of 70 kg./Acre

-

Encourage co-production of plants, for example can cultivate wheat with Mentha

-

Taking measures to control speculation on MCX and other speculation trends

-

To regulate water irrigation, suggesting/providing Drip Irrigation system

-

Encouraging solar energy use for irrigation

-

Providing canal water for irrigation

-

Make an all-out effort to reach consumers directly, avoiding traders and middle man

-

Providing technical knowhow to reduce distillation cost

-

Providing written material for farming through scientific means

TECHNICAL VIEW

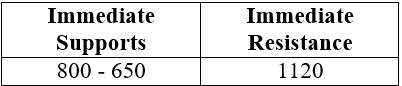

Mentha Annual View: The Daily Chart and the weekly charts looks like the prices are in a bearish tone and more of the choppy trading activities in the future markets with low volumes.

The nearest resistance is seen at Rs.900 mark and the very crucial and important resistance is Rs.965. The immediate support is seen at Rs.820 and the crucial and pivot point is seen as Rs.777. The long term support is seen at Rs.710 from where reversal possibilities are highest.

Technically speaking Positional Players are advised to take a Long position in the first month contract of Mentha in the range of Rs.780-790 for the immediate upside of Rs.895 and any move above Rs.965 can take the prices to previous year high of Rs.1145. A weekly close below 710 will negate my view.

Weekly Chart – Mentha Oil (MCX)

Market Views – Market was range bound in year 2015 between 700-1150 and trading in the same zone in year 2016. Though it is holding above the support of 650 and also getting support at 800 levels, the downside is limited. The maximum chances are of staying in this range-bound for 7-9 weeks and long term breakout is only possible above 1120 with high volumes. 1120 is critical level for upside confirmation on Long Term.

Trading Strategy – Look for buy at the supports on levels around 800. Partial Profit bookings at the levels of 1120. Add buy if weekly closing above 1120 for upside levels.

.PNG)

_1.PNG)

| Probability – |

55 % → |

Range-bound |

| |

30 % → |

Upside |

| |

15 % → |

Downside |

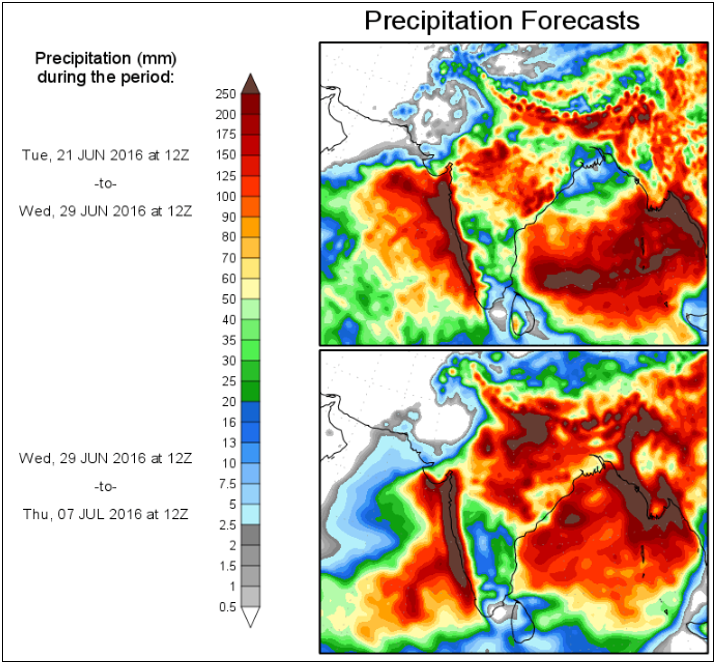

Weather forecasts to remain favourable for mentha crop for the next fortnight.

Piperita oil

-

The current year production is lower by 10% at 550 MT with a carry-forward stocks of around100 MT price might touch 1700 all crop distilled.

-

Prices are likely to firm up and double from current levels, with lower availability of Carry forward stock.

Spearmint oil

-

The current year crop is higher than last year approximately 150 MT.

-

Arrivals have started and prices are likely to remain under pressure, it might touch 1200.