click for Menthol Market Updates :: 2024 - 2025 ::

click for Menthol Market Updates :: 2023 ::

click for Menthol Market Updates :: 2022 ::

click for Menthol Market Updates :: 2019 ::

click for Menthol Market Updates :: 2018 ::

click for Menthol Market Updates :: 2017 ::

click for Menthol Market Updates :: 2016 ::

click for Menthol Market Updates :: 2014 ::

click for Menthol Market Updates :: 2012 ::

click for Menthol Market Updates :: 2009 ::

click for Menthol Market Updates :: 2005 ::

Menthol Market Updates :: 2017 ::

Mentha Oil

In our previous market reports (also available on our website: www.prkchemicals.com), we had summarized the Menthol industry during the periods. We would like to review the current market situation and brief about the current challenges of the industry.

Small farmer’s reliance on mentha as proxy currency is higher and mentha oil is also a part of their normal life and they cannot avoid the love of same.

Since the advent of Synthetic Menthol in 2012, in a big way courtesy BASF; and thus was born a rivalry between Natural Menthol and Synthetic Menthol. The current scenario in the industry is that of farmer’s reluctance to mentha oil and the emerging competition from the new capacities being built by synthetic mentha producers.

In the battlefield of ‘PRICE”, the synthetic mentha oil looks to have defeated the farmers love towards the crop and supply worries for natural mentha oil would be cause of worry for the industry.

Synthetic Menthol successfully covered the lid on prices and speculation. Indian farmer now have to check the Synthetic Menthol production cost in order to sustain the survival from the PRICE decider (synthetic menthol).

Earlier to the emergence synthetic mentha oil, consumers have to focus on supply side risks such as weather and crop, which controlled the prices. With the advent of mentha synthetic mentha oil, the supply side risks have far been countered.

It was presumed that the cost of Synthetic Menthol is between $ 13.50-14.50/kg. But the manufacturers were supplying at close to $ 12.50/kg, probably because of some old commitments. Whereas Natural menthol, was priced around $ 16.50/Kg. It appears now that both are comfortable at these price levels.

The highlight of this report would be the stock ratio, an important barometer for commodity price and the impact of synthetic mentha oil in the same.

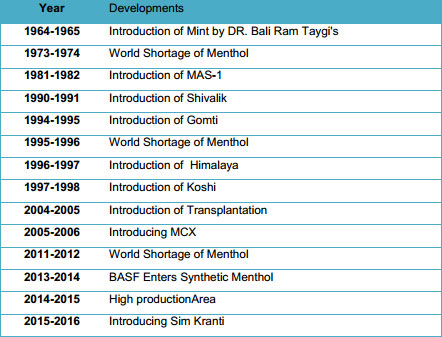

Important Timelines in Mentha Industry

Mentha oil industry has seen major changes in the last five decades. India was earlier an importer of mentha oil, but with the green revolution mint took off as an agriculture commodity and now India is the biggest producer and exporter of mentha oil and its products.

The commodity which was earlier traded basically on demand and supply had to face the extra jolt of speculative activities since its launch on MCX. With higher speculative activities and eventually more uncertainties in the markets, the advent of synthetic menthol became a reality.

The production of mentha oil which once stood at 48,000 MT is now just around 31,000 MT due to competition from the synthetic menthol.

Let’s Recap 2016-17:

-

Last year mentha markets remained quite stable with restricted speculative activities

-

Most of the mentha arrivals were hedged on MCX futures by major cash and carry arbitragers.

-

Post November, the highlight of the Indian commodities markets has been the impact of demonetization on the farmer’s behavior.

-

The commodities markets in the country have started to pay the farmers in banking accounts, hence the farmers are least interested to liquidate stocks and keep the money in banking systems.

-

With elections in UP in March 2017, and to get the benefit of loan waivers if any decided by the new government, and also cash crises in the systems- farmers are just bringing for the hand to mouth usage.

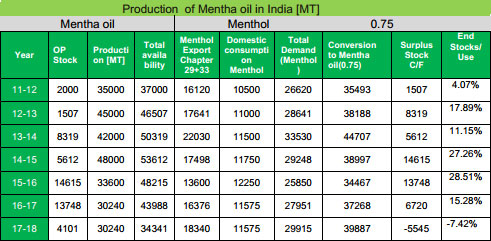

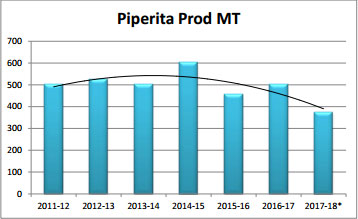

MENTHA OIL PRODUCTION –

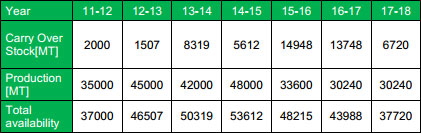

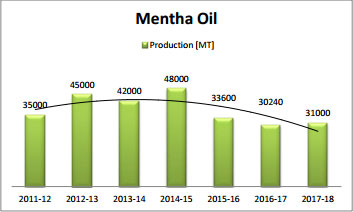

Total Availability of Natural Mentha oil[MT]

The stagnancy in prices has already started taking a toll on production of natural mentha oil in the country. Production of mentha oil is seen at multi-years low. Also, with a falling carryover stocks from previous years and strong export demand, the total availability of mentha oil is seen at levels not seen at least in last 7/8 years.

Over the last few years, the production has shown a declining trend. The competition from synthetic mentha is seen as taking toll on Indian production of mentha oil.

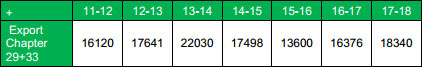

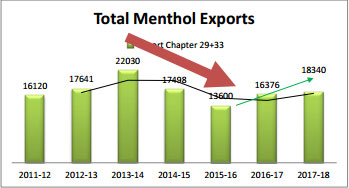

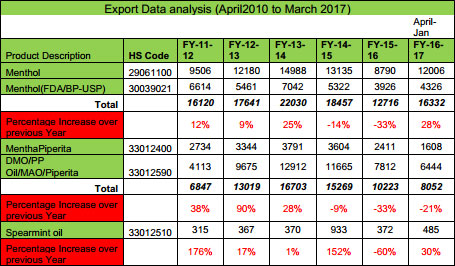

Total Menthol Export [Qt. MT.]

Although the production of natural mentha oil is falling, the export demand shows a rising trend in recent years. The global availability of synthetic mentha oil is yet to show any impact on the exports of mentha oil. This indicates that the global demand of mentha oil remains robust, and new additions to the capacities may not impact the exports from the country.

The impact of synthetic menthol can be clearly seen post 2013-14. With entry of synthetic menthol, natural menthol exports fell almost to 55% from the highs in 2015-16 from two years back.

One should keep in mind that the fall is exports is only resultant of synthetic menthol and the overall demand of menthol has been rising with a firm trend. In last year we have already seen a positive trend in exports of Indian menthol, which is likely to continue in coming years despite cost benefits of synthetic menthol.

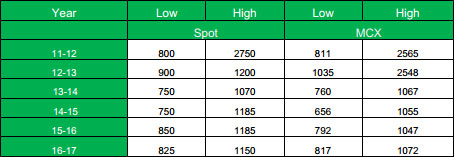

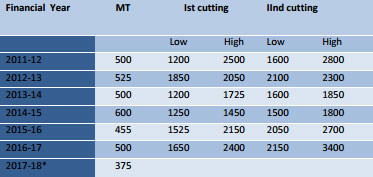

SPOT PRICES – ANNUAL HIGH LOW -

Last three year mentha oil dissuade the low and high level

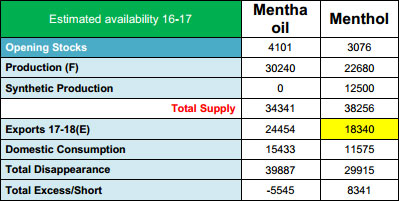

Estimated Availability Mentha oil 17-18(E)

Natural mentha oil ending stocks are at alarming low levels, any slightest deviation of synthetic mentha oil production will make the commodity favorite for speculation wherein buyers will run helter skelter to cover positions.

Negative carry stocks indicate that we have to use synthetic mentha to cover our needs or have to cut down on demand. Any lowering of demand for natural

menthol would be possible only if the price difference between natural and synthetic menthol widens. Since synthetic menthol is already at lower cost benefit, such a case would arrive only if prices of natural menthol increase.

**Stock/Use ratio is the ratio at which we are expected to move in with the end stocks in the new season. Lower the ratio, higher the changes of volatility in

case of any variation during sowing / harvesting period of the crop.

As we can see from the data above we are expected to start the current season with 15.28% ratio which is at lower range. However in the year ahead we are expected the ratio to be negative. Since negative stock/use ratio is practically not possible, this indicates we have to depend on synthetic menthol to support the export demand. Hence if there is any deviance or delay in synthetic menthol production, we expect prices to shoot up in no time so as to lower the demand at higher levels and thus we remain cautiously bullish in markets.

Menthaoil/ Menthol

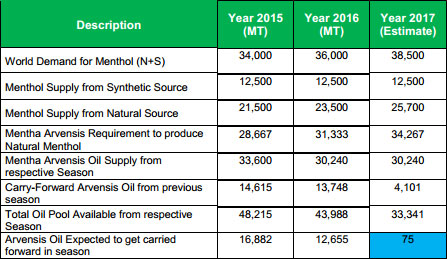

World Demand and supply natural & synthetic:-

The carry forward of mentha oil Arvensis is shrinking year to year. Any supply disruptions, even for a shorter period can lead to a volatile explosion.

2017-18 Future Ahead:

-

Farmer’sunlikely to bring goods in bulk quantity, thanks to the inclusion of banking systems and demonetization by the government.

-

The production of natural mentha oil is declining as farmers see less incentive in mentha oil, although mentha oil is in the heart of the farming community

-

Much more fear in the minds of traders about the future of markets due to synthetic menthol.

-

Most of the goods are likely to again be delivered on MCX warehouses.

-

BASF to commission production of synthetic menthol in December 2017.

-

Natural mentha oil end stocks are reaching at a alarming low levels

-

Introduction of GST is likely to bring in more investors in the commodity as trades become open.

-

Indian farmers will have to take on lower production cost techniques

-

Farmers will have to adopt higher recovery roots and also opt for soil testing techniques before indulging in farming

-

Industry will have to opt for techniques to lower the distillation and manufacturing costs

-

Exports of finished goods gives a value addition and higher remuneration, hence exports of raw materials should be avoided.

Technical Analysis

Mentha Oil view:

Technically speaking Mentha Oil breached the very crucial support of Rs.900 and fell sharply to Rs.885 levels creating a panic like situation. But the recovery was so sharp and sustainable that market went on to hit the high of Rs.965, the technical term used for the situation is pinukia where in the market fools by breaching the crucial level and recovers to reach new high.

The Fibonacci retracement levels indicates a short term Buy around Rs.940-945 zone for the upside potential of Rs.1051 with intermediate resistance at Rs.987. Breaking of Rs.900 levels again should negate our view.

For the investor: If the upside resistance of the triangle breakout and closes above

Rs.1080 investors can get handsome returns targeting Rs.1240 in very short term.

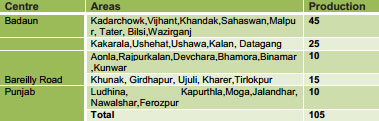

Piperita oil

Piperita Production Area (In India North East Region):-

-

Piperita mentha market has its own demand owing to good quality of crystals.

-

The production of Piperita has declined due to poor quality roots

-

Owing to its superior quality and declining production, prices of Piperita mentha are likely to remain strong in future.

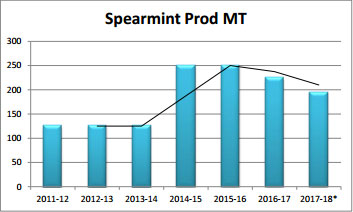

Spearmint Oil

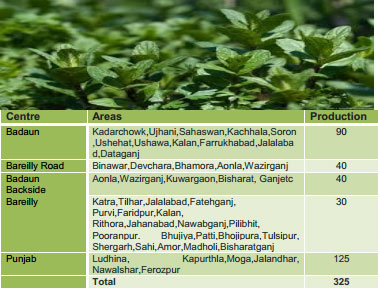

Spearmint Production Area:-Badaun

SPEARMINT OIL

-

Spearmint has a very unique characteristics quality.

-

Production of spearmint have also declined in recent years owing to availability of synthetic variant

-

Owing to its superior quality and declining production, prices of spearmint are likely to remain strong in future.

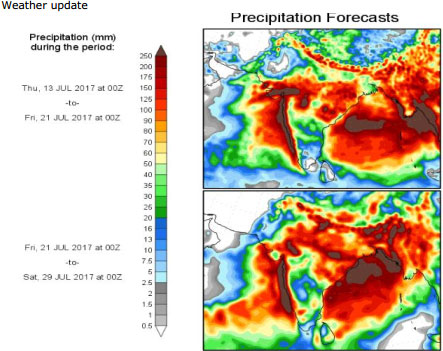

We expect heavy to heavy rainfall in the next 15 days time in Mentha producing regions.

Prateesh Kumar Gupta

CEO-Mint & Herbals,Mobile/Hand Phone:+91-9412295642

PRAKASH CHEMICALS

AnajMandi ,Budaun -243601(UP) India

Tel:+ 91-5832-224642,+91-9368595642,Fax:+91-5832-225243

Email: prkchem@prkchemicals.com , prkchem@yahoo.com Web: www.prkchemicals.com

DISCLAIMER: This report is neither an offer nor a solicitation to purchase or sell Commodities. The information and views expressed herein are believed to be reliable, but no responsibility (or liability) is