click for Menthol Market Updates :: 2024 - 2025 ::

click for Menthol Market Updates :: 2023 ::

click for Menthol Market Updates :: 2022 ::

click for Menthol Market Updates :: 2019 ::

click for Menthol Market Updates :: 2018 ::

click for Menthol Market Updates :: 2017 ::

click for Menthol Market Updates :: 2016 ::

click for Menthol Market Updates :: 2014 ::

click for Menthol Market Updates :: 2012 ::

click for Menthol Market Updates :: 2009 ::

click for Menthol Market Updates :: 2005 ::

Menthol Market Updates :: 2018 ::

Mentha Oil

Our caption picture might appear different and somewhat strange but is true! Isn’t mint industry behaving strange and different. Today the whole world is moving towards natural products but our industry is taking a backstep? We don’t know the effects of synthetic menthol as yet but still are putting some eggs in one basket. Our last year’s report started with the same proverb i.e. “Don’t put all your eggs in one basket” – famous English proverb, we all must have read thousands of times, but still ignore it to pay the prices later. Similar situation emerged in the mentha oil industry last season where end users relied mostly on synthetic mentha oil products, which were although smaller in quantities but had greater impact on price.

Mentha Oil has given a perfect opportunity to those who believed in the poor supply of mentha oil, as was predicted last year. Extra dependence on synthetic mentha supply had taken toll and in turn gave lesson to many in the industry.In our previous market reports (also available on our website: www.prkchemicals.com), we had summarized the Menthol industry during those periods. We would like to review the current market situation and brief about the current challenges of the industry.

Till last year, farmer’s were reluctant to cultivate mentha oil because challenges from the new capacities being built by synthetic mentha producers. But failure of synthetic mentha supply has given fresh lease of life to farmers, its their time to prosper again.

This year in the battle between mentha “AVAILABILITY” and “PRICE”, the ‘price’ is winning. It is due to decrease in availability of synthetic mentha the price of natural mentha increased and henceforth there is a huge increase in speculation activity.

Mentha Oil industry is now currently at the mercy of sellers unlike at mercy of buyers till last year.

This speculation activity has emerged winner and users are seen running helter skelter to cover their upcoming demand which is in no mood to go down. Investors/End users will now shift their focus from price to availability and hence importance of Indian Mentha industry resumes, again.

Aroma industry which was on a sleep mode since 2013 has woken up and is is roaring. This is just because of failure of one synthetic supplier!

Here’s a Recap of 2017-18:

-

Last year was a perfect year to start with:- as was mentioned in our yearly outlook for 2017-18. we had predicted deficit of mentha oil and had also mentioned the alarming low stocks of mentha oil.

-

Also we had hinted at possible speculation arising because of any disruption in supply chain.

-

The worst happened; fire broke out in BASF production unit and gave traders one of the most unexpected bull run, in years.

-

Opening stocks of mentha oil were very poor and in addition the oil recovery was poor for the season

-

Worst was for consumers who did not have stocks and relied on their depleted buffer stocks

-

Thanks to goods availability at MCX warehouses that the supply was seen at regular pace or else a supply vacuum would have exploded the situation exponentially

-

End users relying on synthetic mentha supply had to cover positions and henceforth the price skyrocketed as speculators also joined the bandwagon

-

Stockiest and traders got the perfect exit with huge profits, even above their expectations.

-

Overall it was a great year for the industry wherein everyone had their own role to play with taking the profits.

-

Traders and end users relying on synthetic menthol supply would now need to review their strategy so as to avoid catching on the wrong foot at the last moment.

-

Due to demonetization and GST, stockiest were out of the market and farmers had mostly sold the goods or had left with little stocks, by the time rally started

MENTHA OIL PRODUCTION –

Arvensis Crop Survey ( 2018-2019 )

There has been general perception of higher inclination of farmers towards mentha oil production owing to higher returns last year. However the rise in area is modest. Production of mentha oil depends on the availability of roots and also land availability by farmers. Hence the production of mentha oil is dependent on various factors and not just the price for farmers to attract towards sowing.

Our team which visited the fields found that the average oil recovery this year is going to fall over the last couple of years. Net effect the overall production is just higher by around 20%. With the price rise and falling prices of other crops traders had forecasted the production to rise by handsome amount which is being negated in initial surveys.

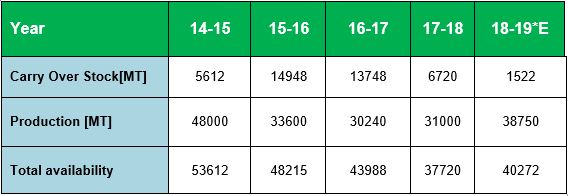

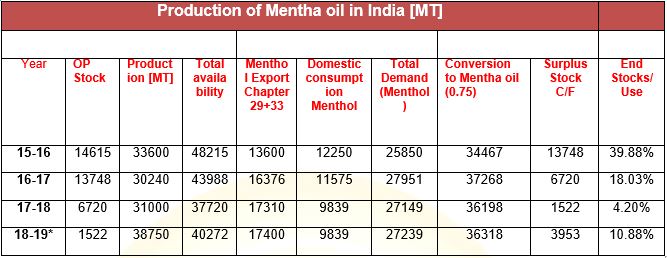

Total Availability of Natural Mentha oil [MT]

Production of mentha oil had been stagnant in the last few years. However, with sharp increase of prices last year there would be some extra production seen this year as compared to the last few years. However, we are still far below production levels seen in 2014-15 and in turn the total availability of natural mentha oil will improve, but still at distant stocks availability seen in the years before the last one.

Although we see a rise in area for mentha oil the initial reports from ground levels are not as encouraging as it did in last few years. Also news coming of early start of Indian monsoon may have negative effect on recovery of mentha oil from the blooming plants.

It’s interesting to note that our production expectation of 38750 MT is just above the average production of 36,968 MT productions seen in between 2013-2018. Hence the apprehension of a massive production over last year due to higher prices may be negated.

The trend in the commodity is mostly defined by the end stocks or carryover lefts for the season. The tight the end stocks to use ratio more is the bullish trend in the commodity.

We had seen historical low carryover stocks of mentha oil in domestic markets last year, this year again we are entering the new marketing year wherein the stocks to use ratio is more tight and making the commodity vulnerable to any supply disruptions, even for a short term.

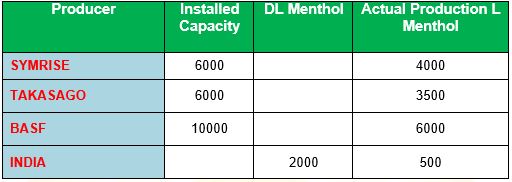

World Synthetic Menthol Supply

-

World carryover stocks of mentha oil are at negligible levels. The two prominent sources of supply are higher production expectations from India and resumption of synthetic mentha oil production at BASF facility.

-

The carry forward of mentha oil Arvensis is shrinking year to year. Any supply disruptions, even for a shorter period can lead to a volatile explosion.

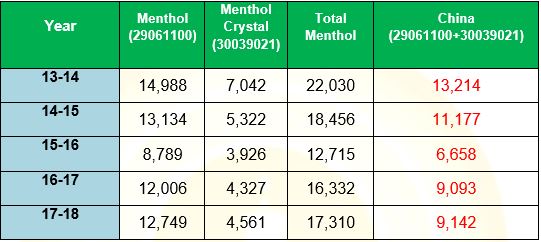

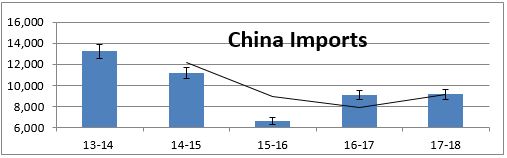

Total Menthol Export [Qt. MT.]

Mentha oil exports have been on a declining graph since 2013-2014. Few factors which were leading to fall in exports were

-

Higher stocks available with end user

-

Availability and supply of synthetic mentha oil (more in terms of metal fears rather than actual figures)

-

Industry started balancing itself from the price jerks in the previous years

Much had been spoken of the fire at BASF unit and non availability of synthetic mentha oil. However if we study the data carefully one would see that the increase in exports is negligible than the previous years. This indicates that the industry relied more on synthetic mentha, and once the synthetic mentha was not available they had to jump their guns. This also indicates that

-

Exports were similar in line with previous years

-

Synthetic mentha bigger pie of natural mentha oil, and once the availability resumes, we can see negative pressure on Indian mentha oil

China- The Big Brother

-

China imports more than 50% of Indian natural mentha oil products exported every year

-

With growing trade war conflicts with China and rest of world, this year the Chinese imports are likely to remain higher to narrow the trade deficit.

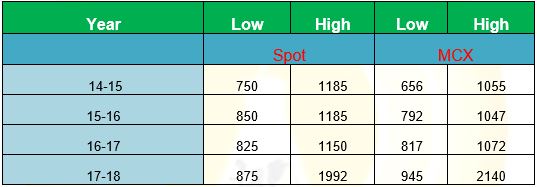

SPOT PRICES – ANNUAL HIGH LOW

Estimated Availability Mentha oil 18-19(E)

Recovery ratio of Menthol at 75% from Mentha Oil

Natural mentha oil ending stocks are at alarming low levels last year. Fear of deviation of synthetic mentha oil production triggered speculation wherein buyers ran in havoc to cover positions.

Carry stocks indicate that we have negligible carry over world over. Supply depends on synthetic mentha production capacity and how soon or late they take to make the production. Since synthetic menthol supply is in doldrums (although it is expected to resume soon) the tightness in the availability of mentha oil will be seen till the time arrivals pick at highest pace or production of synthetic mentha oil resumes to the comfort of buyers.

**Stock/Use ratio is the ratio at which we are expected to move in with the end stocks in the new season. Since the 2017-18 ratio turns indicates negligible carry, chances of volatility rise again if there is any weather impact during the harvesting period.

As we can see from the data above we are expected to end the current season with around 10% ratio of end stocks to use. The end stock ratio indicates we will be again having a watertight year from supply front. Supply of synthetic menthol to will play a pivotal role and if there is delay in synthetic menthol production we may see fireworks continue this season as well.

Menthaoil/ Menthol

World Demand and supply natural & synthetic:-

Planning for year ahead-

Mentha Oil had given a fantastic return to farmers those who held it for want of higher prices. Since the spot prices reached levels wherein most farmers and traders booked profit and made their inventories at almost zero levels.

This year again if the prices fall below a certain level, farmers and traders will start building stocks. Marginal farmers will also not bring the goods immediately and a situation of hand to mouth and virtual tightness could be expected.

Based upon the price range we expect there could be variation in the supply of goods from farmers. We expect the following 2 scenarios for the given price band.

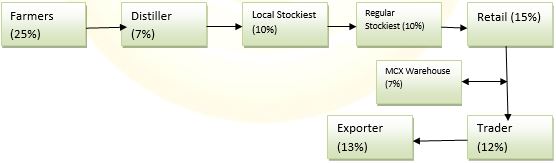

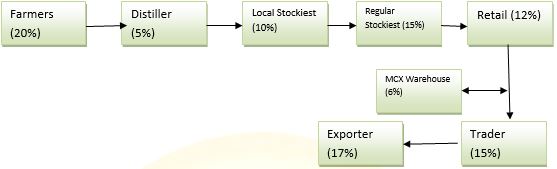

Supply Chain in Mentha Oil:

-

Mentha oil is expected to remain in firm hands at every stage of supply chain participants this year

-

The supply will come into the market but only as and when the prices are achieved at higher levels as expected by the participants

Category I- If Prices between 1050-1250 per Kg

If mentha oil prices hover at the lower ends of the price band it had seen last year, we would see stocking of goods at higher percentage right from the producer and end users would brace for supply of the goods.

Category II- If Prices between 1250-1600 per Kg

If mentha oil prices hover at the higher ends of the price band it had seen last year, we would see selling of goods at higher pace from the producer and end users would get good amount of mentha oil to meet the export demands of the products.

Current Scenario:

-

Having seen phenomenal return in mentha oil prices last year, farmers are holding big amount of the produce, expecting a better returns- psychologically Rs 2000 per kg is seen achievable from the farmers view, and supply would come at those levels.

-

Inventories by manufacturers are poor and exporters are already trying to cover the short positions due to forward sales of shipments and good demand.

-

Uncertainty about the quantity and timelines of synthetic mentha production by BASF is making traders nervous about the trade, and virtually about existence in business.

2018-19 Future Ahead:

The risk of a wrong decision is preferable to the terror of indecision. – Maimonides

-

Mentha oil marketing year is expected to start with higher production, poor carryover stocks and possibility of resumption of artificial mentha oil production

-

Mentha Oil industry is confused with regards the magnanimous crop size of current year, creating confusion in the complete chain that prices would be pressurized during its arrival period.

-

Inventory levels of consumers and end users are at very low levels, participation from all players will emerge as new crops come.

-

We already are witnessing a phase of continuous good demand, most significantly the warehouses on MCX which were supposed to be confirm source of supply are empty.

-

MCX hedger would only suppress the market if the warehouse stocks on MCX crosses 10,000 barrels.

-

Having felt the essence of higher prices last season, farmers will not sell the goods at one tranche, they would take risk and sell in small pockets, farmers would sell only if the prices increase and holding back if prices fall, arrivals would be at slow pace.

-

Being the start of season at higher levels, this year would probably a good season for the industry as a whole.

-

Stocking by farmers this year is seen between 60-65%, against the normal holding of below 50%, indicating strong price expectations by the farming community. Stockiest also are expecting better price returns and would like to hold goods for longer period.

-

One should track the developments on synthetic oil production, unconfirmed reports though indicate production from Malaysian unit to resume by July 2018

-

Last few years natural mentha oil prices were subdued because of “PRICE” war carried by the synthetic mentha oil, and hence we should be ready to compete in “PRICE” once “AVAILABILITY” stabilizes.

-

Natural mentha oil end stocks are at a alarming low levels, any deviation in production estimated due to weather fluctuations may worsen the supply situation

-

As per initial reports, yields are expected to be disappointing this year as compared t last few years

-

Industry will have to cover risk with uncertainties surrounding the industry, once supply is fixed, we will see prices factoring the risks and normalization of prices.

-

Exports of finished goods gives a value addition and higher remuneration, hence exports of raw materials should be avoided.

-

Domestic demand of consumer based mentha oil is still at wrong calculations, consumption remains strong.

-

According to our forecast we may again see sharp upside potential in mentha oil prices, unless the world pipeline is filled with good amount of synthetic mentha oil

-

The current year is expected to be one of the historical years in trade with every participant waiting to get its share in market with positive approach toward the market, basically in natural mentha oil.

-

Fundamentally base price of mentha seems to find a good support at Rs 1200 per kg levels of Chandausi spot market.

Technical Analysis

Mentha Oil view:

The Consolidation Breakout in Mentha Oil above the crucial levels of Rs.1148 triggered a rally towards the year high of Rs.1991.90. A Sharp fall or correction was then witness till the levels of Rs. 1540 and prices moved back to test Rs.1763.

In the current scenario the prices have breached the previous low of Rs.1540 and the hot commodity in the previous year has now moved to a downtrend. The Formation of higher tops and lower bottoms also confirms the downtrend.

Elliott Wave Analysis-

By analyzing the weekly chart it looks the major pattern has ended at 30-06-2017 low of 870. The new pattern has emerged pointing upside in the form of A-B-C.

Wave A has completed at the high of 1991.90, Wave B has completed at low of 1106.

Wave B is 78.6% of wave A and now Wave C is unfolding. 1st Segment of wave C has touched 1540 which is 38.2% of correct of AB.

Wave C is expected to be 78.6% FIB proj of AB and the new projected target is 1992.

M.Piperita oil

-

Punjab is expected to produce 350 MT while in UP the first cutting is expected to yield 350 MT and second cutting is likely to fetch 150 MT

-

The yields reported were disappointing and the average oil recovery is was 50% less for the first 150 MT

-

The first cutting yielded 3.5 kg per bighas and the yield of second cutting needs to be seen

-

Piperita mentha market has its own demand owing to good quality of crystals.

-

Farmers had least interest till last year for sowing of Piperita as they had shifted to DM products

-

International customers had to jump in to cover positions which lead to sharp rise in prices

-

Around 60% of the current year harvested crop has already been exported at one of the fastest pace

-

Owing to superior quality and 0 carryover stocks, prices of Piperita mentha are likely to remain firm in future.

-

The inventory build in the last 5 years of Piperita has been almost consumed

M.Spearmint oil

-

Spearmint added new customers owing to its special features.

-

Customers are looking for natural products which are developed inhouse

-

The industry perception of blending has reduced in the last year years

-

Adulteration checking parameters of L carvone are available with us, if needed do email us

-

Owing to poor inventory and increased consumption, prices of spearmint are likely to remain strong in future.

Prateesh Kumar Gupta

CEO-Mint & Herbals,

Mobile/Hand Phone:+91-9412295642

PRAKASH CHEMICALS

AnajMandi ,Budaun -243601(UP) India

Tel:+ 91-5832-224642,+91-9368595642,Fax:+91-5832-225243

Email: prkchem@prkchemicals.com , prkchem@yahoo.com

Web: www.prkchemicals.com

DISCLAIMER: This report is neither an offer nor a solicitation to purchase or sell Commodities. The information and views expressed herein are believed to be reliable, but no responsibility (or liability) is