click for Menthol Market Updates :: 2024 - 2025 ::

click for Menthol Market Updates :: 2023 ::

click for Menthol Market Updates :: 2022 ::

click for Menthol Market Updates :: 2019 ::

click for Menthol Market Updates :: 2018 ::

click for Menthol Market Updates :: 2017 ::

click for Menthol Market Updates :: 2016 ::

click for Menthol Market Updates :: 2014 ::

click for Menthol Market Updates :: 2012 ::

click for Menthol Market Updates :: 2009 ::

click for Menthol Market Updates :: 2005 ::

Menthol Market Updates :: 2019 ::

Mentha Oils

Our caption picture might appear different and somewhat strange but is true! Isn’t mint industry behaving strange and different? The world is keen and eager to buy natural Mentha, albeit at lower levels but Indian farmers are not willing to sell at lower prices. The buyers are thinking of lower levels so we have to see who blinks first!

In the last Four FY (2016-17 to 2019-20), Mentha Oil has been the golden age for Mint industry. The Infrastructure and Production technology of Indian Mint industry production has grown leaps and bounds. Today the Indian mint Processing installed capacity is at present higher than earlier. This has become possible because of up-gradation of technology.

By the support of Indian Government, the agriculture production also saw improvement in technology. It has helped in improving the quality of oil production as a new variety of Mentha “GOLDEN” was introduced. This was mentioned in our report of 2018. Today we are in over supply mode and so we saw some drop in prices. But still the prices shall fluctuate between 1300-1500 INR.

By the support of Indian Government, the agriculture production also saw improvement in technology. It has helped in improving the quality of oil production as a new variety of Mentha “GOLDEN” was introduced. This was mentioned in our report of 2018. Today we are in over supply mode and so we saw some drop in prices. But still the prices shall fluctuate between 1300-1500 INR.

Last Three years have brought great profit to farmers so the non-Mentha public joined the bandwagon. The stocks have thus spread thin amongst Big farmers, Small stockiest, small farmers, manufacturers, exporters, local traders etc. this also is responsible for supply pressure in market and buyers were aware of big crop so they also did not rush to buy continuously. Thus the demand was slow and steady. but it is certain that there is a lot of demand and everyone will have to take more.

If you want to understand the year more, Synthetic Menthol started coming in FY 2013-14. This was taken very lightly by Natural Mentha Industry of India. Infect Synthetic Mentha starting complimenting Natural Mentha as it controlled wild fluctuation and speculations. (It can still be viewed by visiting our website www.prkchemicals.com FY 12-13. A lot is the same scenario this year too.

Let’s recap 2018-19 prices Trend-

-

Towards the season start of 2018-2019, industry players anticipated 25% higher crop on the back of 25% rise in area

-

The industry was holding lower stocks at the start of 2018 season

-

The season started with higher prices, and stockiest kept away from Mentha Oil

-

Manufactures too procured stocks to cover export commitments which was hand to mouth

-

In the first half of season, the supply remained steady but towards the second half of year as the supply squeezed, traders and importers ran to cover short positions for their positions

In the first half of season, the supply remained steady but towards the second half of year as the supply squeezed, traders and importers ran to cover short positions for their positions

-

Speculators were short on futures and even exporters to some extent were uncovered on expectation of higher Mentha oil production

-

Narrow GAP between demand and supply always kept buyers active in the market

-

With every record price, stocks with stockiest came out of the warehouses, making end inventories tighter

-

Hence buyers reluctant to enter at the start of season had to accept higher prices later

-

Non performance of contracts by suppliers eventually forced buyers to re-order and thus creating some desperation.

-

Weakening of rupee to record lows, made it lucrative for exporters

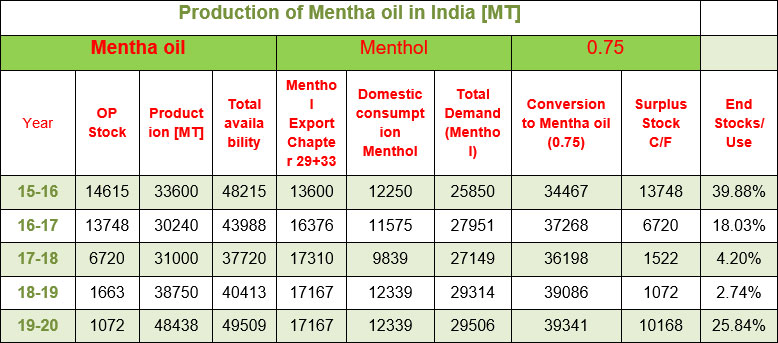

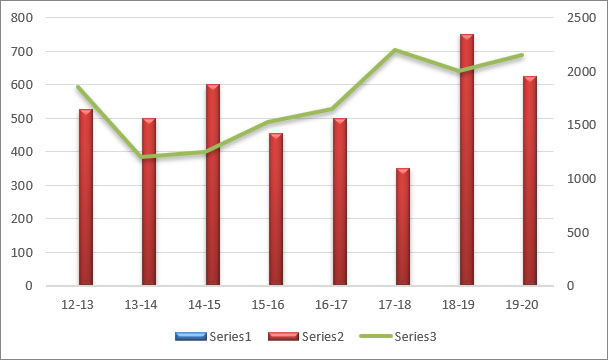

MENTHA OIL PRODUCTION –

Now if we analyze the production of last four years then we can see that the average crop size is 33,000 MT and this is produced in traditional cultivation areas. Now this increase come from nontraditional areas, whose farmers got interested to grow Mentha as they saw good prices in it as compared to their traditional crop, in other words we can categorize them as “fly-by-night” operators who might not cultivate Mentha if the profitability is low. Now what does this situation do to inventory? It actually creates an uncertainty in market as the stockiest, farmers and hoarders refuse to sell san profit

Total Availability of Natural Mentha oil [MT]

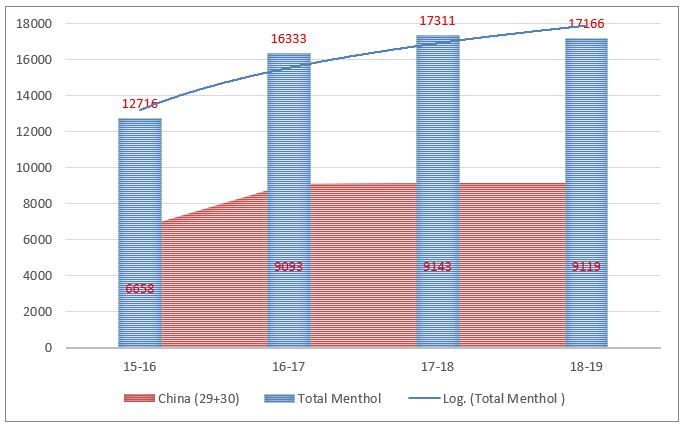

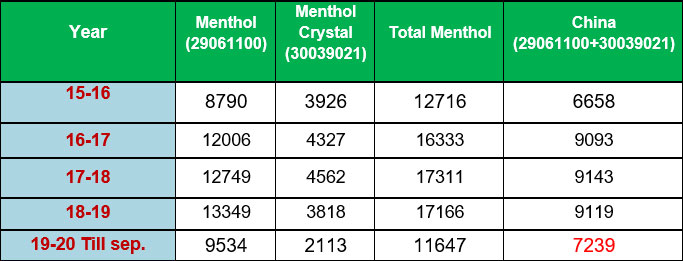

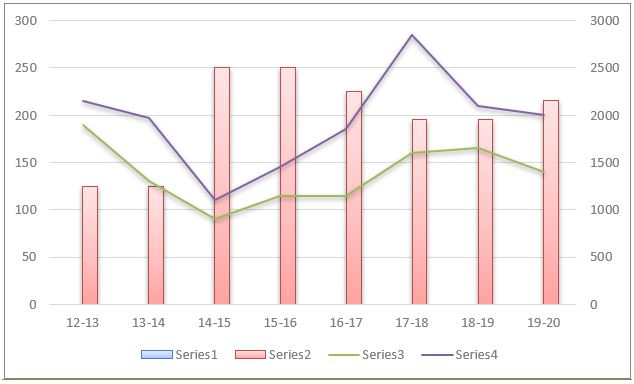

Total Menthol Export [Qt. MT.]

*Till September china last year 2018 Total menthol import 3923.00MT

Now if we analyze exports data of las few years then we can see an average exports of 16,500 MT of Natural Menthal l in International markets. FYI this year an intersting developement is that in current finacial year China has imported around 7239 MT of Mentol Powder, which is around 35% more then y-o-y of last year. Now the question is is demand or are chinese creating inventory because last year saw almost no stocks in China. If this trend continues then we might see a jump of 25% this year. This shall be interesting as this jump shall create a situation wher India shall have very low carry forward stocks!

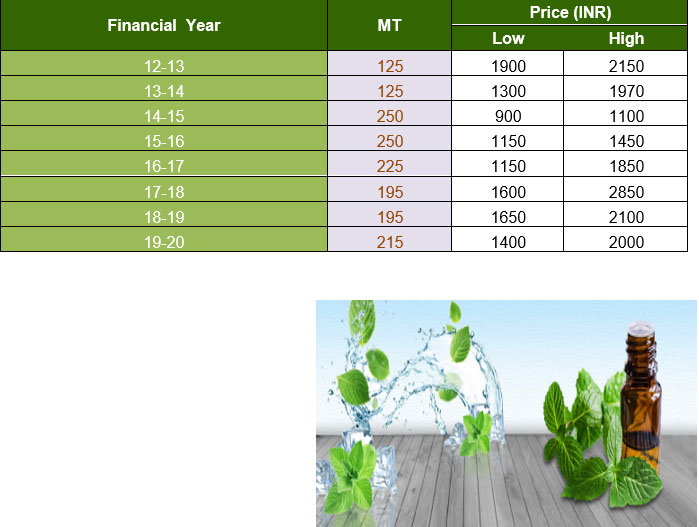

SPOT PRICES – ANNUAL HIGH LOW-

I have always been maintaiong that the market has its own path ever year in which new highs and lows are created. the same can be understood by the below chart.

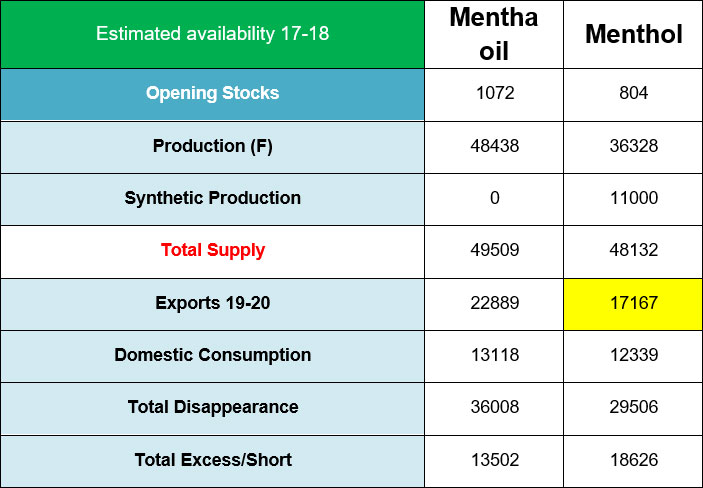

Estimated Availability Mentha oil 19-20(E)-

*Recovery ratio of Menthol at 75% from Mentha Oil

Mentha oil/ Menthol

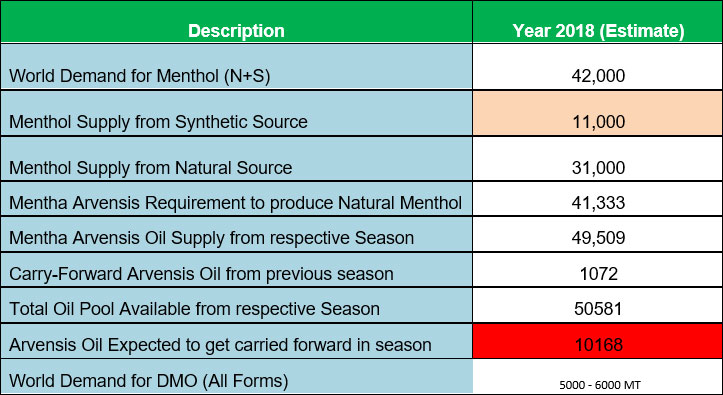

World Demand and supply natural & synthetic:

Planning for year ahead-

In last 4 years indian farmers have earned well and the prices were high even this year unfortunately a great number was sold in advance and this pattern was somewhat successful but in last few weeks the oil arrival has gone really slow and the industry was waiting for oil arrival from new areas but if the farmers from new areas are watching slow arrivals in traditional areas and if they follow suitbthen prices might jump unexpectedly! In fact while this report is beingwritten the prices have already risen by INR 1500-1800. lets wait and watch.

In last 4 years indian farmers have earned well and the prices were high even this year unfortunately a great number was sold in advance and this pattern was somewhat successful but in last few weeks the oil arrival has gone really slow and the industry was waiting for oil arrival from new areas but if the farmers from new areas are watching slow arrivals in traditional areas and if they follow suitbthen prices might jump unexpectedly! In fact while this report is beingwritten the prices have already risen by INR 1500-1800. lets wait and watch.

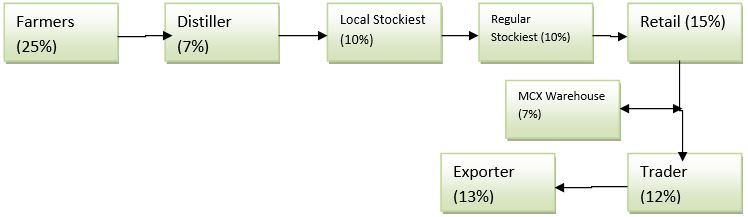

Supply Chain in Mentha Oil 2019:

right from the producer and end users would brace for supply of the goods.

2018-19 Future Ahead:

The risk of a wrong decision is preferable to the terror of indecision. – Maimonides

Technical Analysis

Phase 1 - Market is getting ready to break the 1350 level

Phase 2 - The first breakout should be observed above 1350 levels that can extend the rally for buy trend up to 1510.

Phase 3 - Correction phase should follow next with support of 1350. This can be next look-for-buy opportunity.

Phase 4 - Third phase will have potential to take it to 1670 and 1870 levels.

Phase 5 - Since this can be a very volatile zone – we can expect one or two corrections waves in between for the price to test low of 1550.

Phase 6 - If the prices take the support in the 1510-1550 zones then target of 1870 should end the wave

Weekly Chart Levels

-

Current Market Support Levels – 1100 – 1175

-

Current Resistance – 1350

-

Next Resistance – 1510 – 1670

Mentha Oil view:

M.Piperita oil

8m. Indian Piperita oil Production MT and Price Comparison Chart

M.Spearmint oil

Indian Spearmint oil Production MT and Price Comparison Chart

Thanks & Best Regards,

Prateesh Kumar Gupta

Ceo-Mint & Herbals

DISCLAIMER: This report is neither an offer nor a solicitation to purchase or sell Commodities. The information and views expressed herein are believed to be reliable, but no responsibility (or liability) is